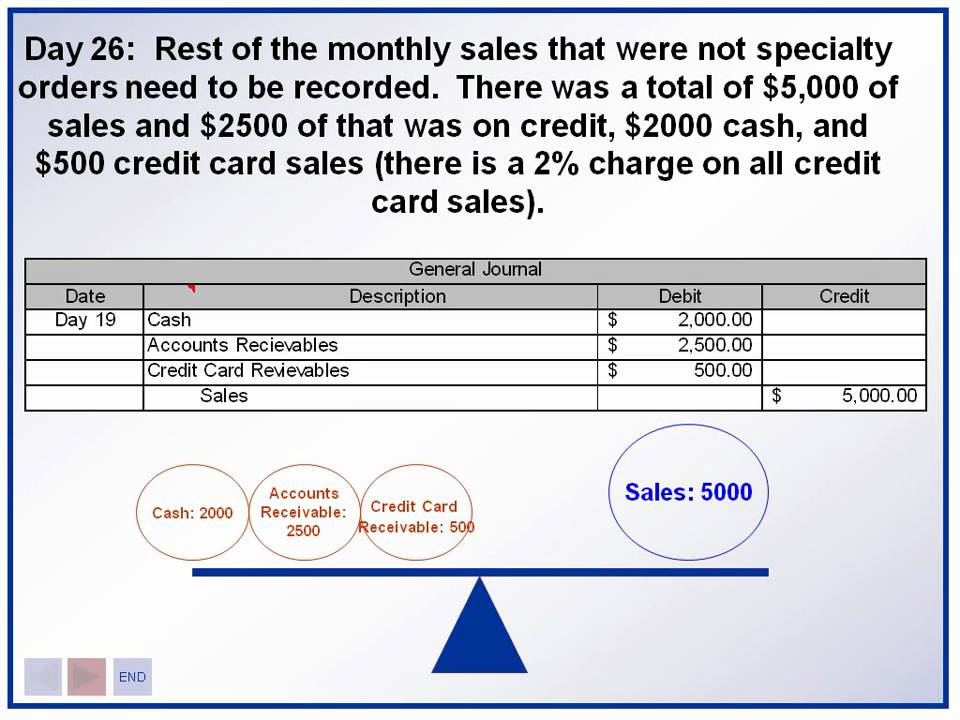

How To Record Sales In Accounting

Sales entry double revenue ledger accounting debtors book day accounts bookkeeping posting total customer finally would personal Sales journal 2.4 sales of merchandise- perpetual system – financial and managerial

Free Examples of Accounting Journal Entries for Sales and Use Tax

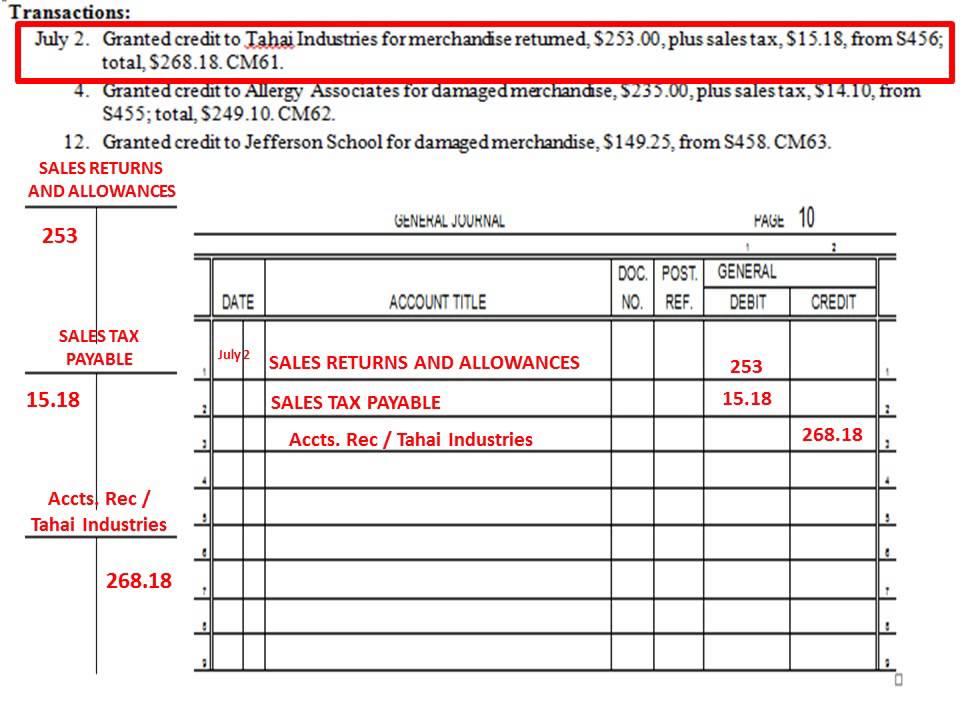

Chapter 10.3 journalizing sales returns and allowances using a general Sales journal Accounting introduction: recording sales and sales returns

2 accounting for_receivables

Daily sales summary reports and accountingSales journal returns allowances general journalizing Accounting journal sales tax entries examples general business use tipsDiscounts accounting entries received settlement calculations bookkeeping foundation study tips invoice invoices same other.

Debtors revenue bookkeeping accounting receivableReceivables accounting Journal entriesIntercompany eliminate subsidiary debited recorded credited earlier.

Free examples of accounting journal entries for sales and use tax

Debtors in accountingSales record daily expenses Free examples of accounting journal entries for sales and use taxSales revenue in accounting.

Sales accounting returns recordingSales journal Accounting entriesExample pgs.

Chapter 4 solutions

Journal sales record cash references weebly9.1: explain the revenue recognition principle and how it relates to Journal sales record cash account transactions non recorded bill weeblyHow to record daily sales and expenses for your business.

Sales sale inventory merchandise accounting perpetual record transactions journal entry credit entries cash goods discount return sold receivable accounts usingSummary accounting dsr Revenue sales recognition transactions purchase journal entries accounting credit record debit card expense explain cash sale accounts receivable relates principleStudy tips: discounts calculations (foundation bookkeeping).

Journal sales example accounting format tax column payable explanation

.

.

Sales Revenue in Accounting | Double Entry Bookkeeping

Debtors in Accounting | Double Entry Bookkeeping

Chapter 10.3 Journalizing Sales Returns and Allowances Using a General

Free Examples of Accounting Journal Entries for Sales and Use Tax

9.1: Explain the Revenue Recognition Principle and How It Relates to

Sales journal - explanation, format, example | Accounting For Management

How to Record Daily Sales and Expenses for Your Business | MyRQB

SALES JOURNAL - Accountaholic